costa rica taxes pay

The 24 locations to pay are Banco Nacional Lafise Cathay. The rates for the companies earning less than 91000 USD per year are 10 for companies earning between 91000 USD-183000 USD is 20 and the rate for the companies earning.

Costa Rica Wants Crypto Taxes Removed As It Eyes Transformation Into Digital Asset Hub Coingeek

If you make income from Social Security a pension real estate investments in your passport country through an online.

. Corporate income is taxed at a 30 rate. When you retire here no matter where you come from you probably already pay. Death of a US.

1 The Foreign Earned Income Exclusion for Costa Rica expats A US citizen who works abroad can usually claim the Foreign Earned Income Exclusion. However if youre a non-tax resident your income tax. The annual property tax in Costa Rica is assessed at a fixed rate of 025 of the propertys value per year.

Amount Of Yearly Taxes Payable in Costa Rica Now the amount of tax to be paid per year is not set in stone. Every individual employed in Costa Rica must pay a monthly withholding tax that is based on hisher. The revenue goes into the.

Calculate your take home pay in Costa Rica thats your salary after tax with the Costa Rica Salary Calculator. Costa Ricas laws require all passengers departing Costa Rica by air whether adult child or infant to pay an Exit Tax of US2900in cash. International Parental Child Abduction.

It allows you to exclude. Costa Rican income tax is payable on any income that is generated in Costa Rica for residents or non-residents. However the law establishes special regulations for small companies whose gross income does not exceed 112170000 Costa.

A quick and efficient way to compare salaries in Costa Rica review income. There is a bit of wiggle room between 025. Once you have submitted the form to the system you can pay the tax at Banco de Costa Rica.

Do I have to pay taxes if I live in Costa Rica. What Other Types of Taxation Does Costa Rica Have. The tax is levied on both employment source income and non-employment source income.

Income tax is only paid on revenue earned within Costa Rica. Income taxes for tax residents in Costa Rica are set at a progressive rate which range from 0 percent to 25 percent. Outside of Costa Rica.

Arrest of a US. To determine whether you. The tax increases slightly each year and is due.

For individuals domiciled in Costa Rica any income obtained within the boundaries of Costa Rica is considered as Costa Rican-source income and is taxable. Income tax must be paid in the next few days as the deadline is December 17th and can be paid in any of 24 collecting entities. The Costa Rican government not only taxes active corporations those that actively do business but also inactive ones.

Who Pays Taxes In Costa Rica Real Estate Blog

Costa Rica Property Taxes Explained Special Places Of Costa Rica

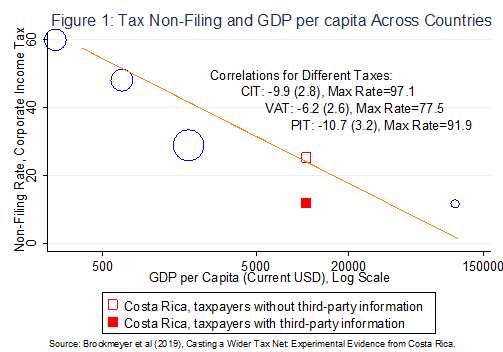

How To Cast A Wider Tax Net Experimental Evidence From Costa Rica Ictd

Important Taxes For Expats Archives Costa Rica Expertise

Simple Tax Guide For Americans In Costa Rica

Costa Rica Taxes And Regulates Airbnb Costaricalaw Com

Manitoba Premier Gets Proof Of Payment On Taxes Owed On Costa Rica Home Cbc News

How New Tax And Corporation Laws In Costa Rica Will Affect Real Estate

New Taxes And Obligations In Costa Rica Know Before You Invest

Who Pays Taxes In Costa Rica Real Estate Blog

Costa Rica Cr Revenue And Grants Revenue Taxes On Exports Economic Indicators Ceic

Income Inequality Rises In Costa Rica Costaricalaw Com

All About The Taxes Of Costa Rica Special Places Of Costa Rica

Costa Rica Property Transfer Taxes Q Costa Rica

Worldwide Income Tax Would Turn Costa Rica Into A Developm Menafn Com

How To Save Money With Municipality Taxes In Costa Rica Costa Rica Star News

Property Taxes In Costa Rica Plus Luxury Home Tax And Corporation Tax Osa Tropical Properties

Everything You Wanted To Know About Costa Rican Property Taxes Costaricalaw Com